COMPREHENSIVE FINANCIAL PLANNING

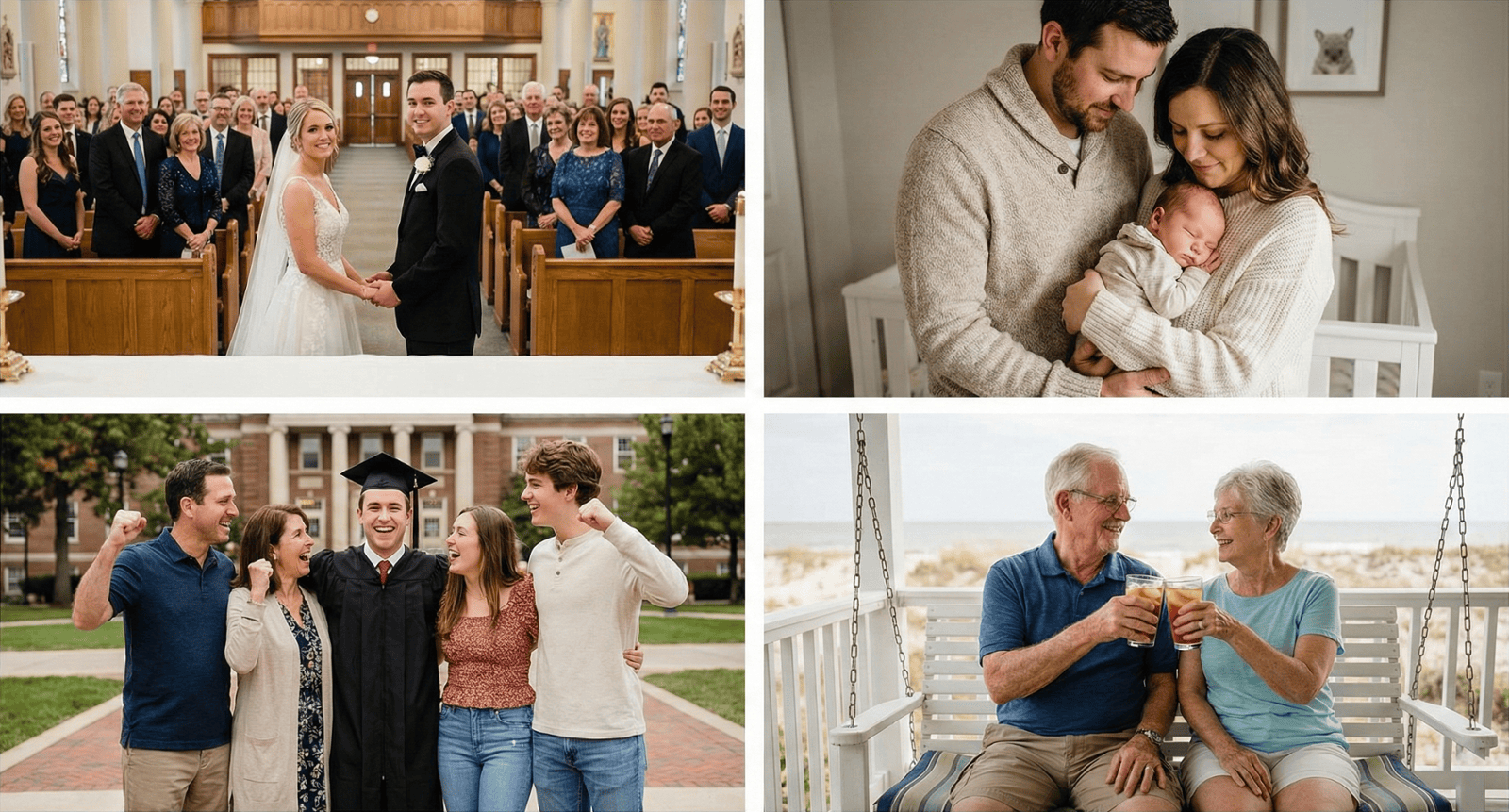

You Have More Goals

Than You Realize

We'll work together to figure out all of your goals, including some you may never have considered or thought about.

A Personalized Plan for You

Your financial plan will show how you'll achieve your goals, including what you should invest in and how you might implement other recommendations such as spending, saving, debt payoffs, insurance, estate planning, and more.

All Parts of Your Financial Life

All areas of your life become a focus of your financial plan so that you have a better chance of achieving your goals.

A Plan That Adapts to Your Life

As your life changes, your financial plan can be quickly updated so any changes or new recommendations can be implemented, making achieving your goals easier and more efficient.

COMPREHENSIVE

FINANCIAL PLANNING

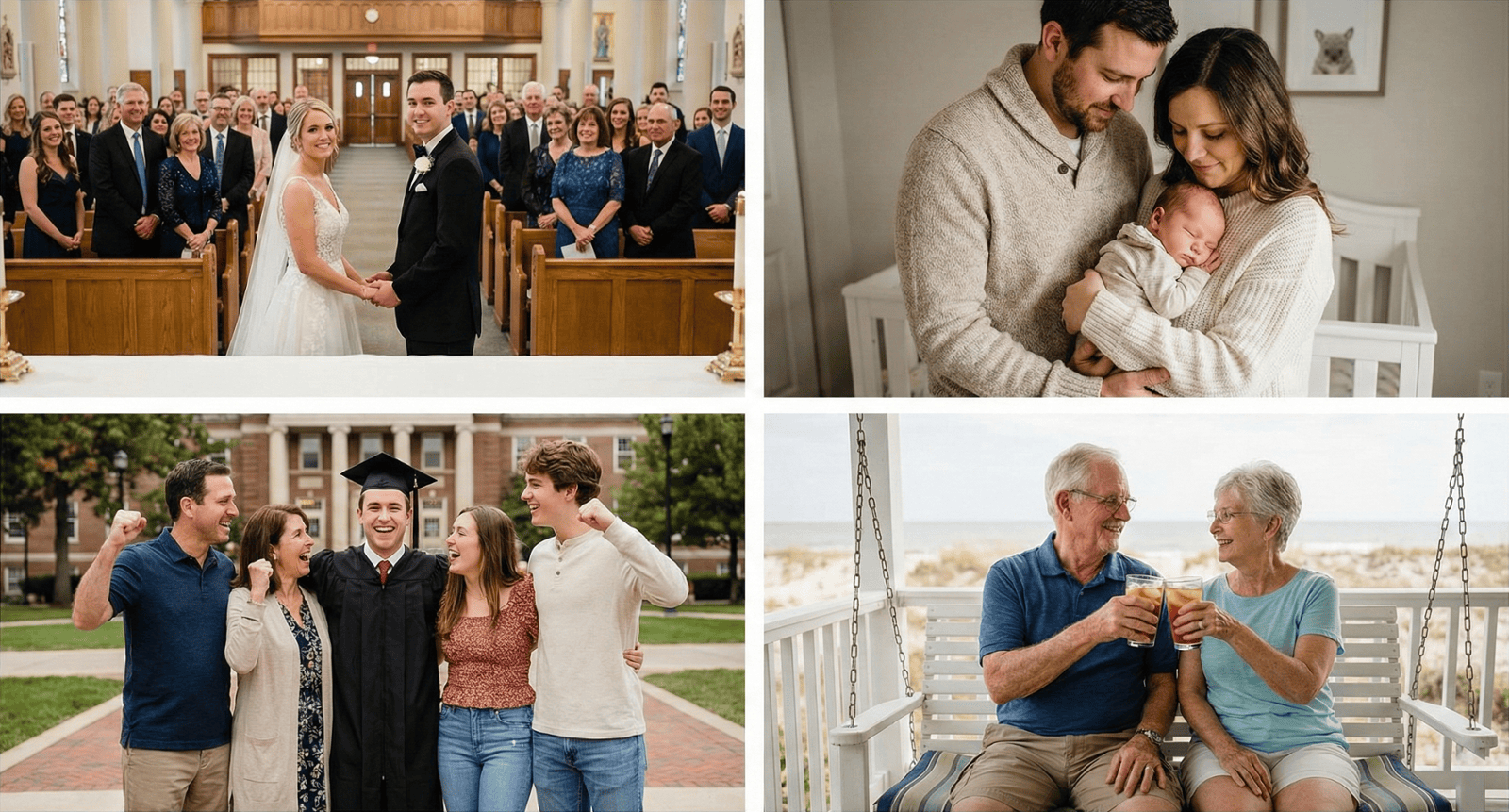

You Have More Goals

Than You Realize

We'll work together to figure out all of your goals, including some you may never have considered or thought about.

A Personalized

Plan for You

Your financial plan will show how you'll achieve your goals, including what you should invest in and how you might implement other recommendations such as spending, saving, debt payoffs, insurance, estate planning, and more.

All Parts of

Your Financial Life

All areas of your life become a focus of your financial plan so that you have a better chance of achieving your goals.

A Plan That

Adapts to Your Life

As your life changes, your financial plan can be quickly updated so any changes or new recommendations can be implemented, making achieving your goals easier and more efficient.

COMPREHENSIVE FINANCIAL PLANNING

FOCUS AREAS

COMPREHENSIVE FINANCIAL

PLANNING FOCUS AREAS

GET A COMPREHENSIVE FINANCIAL PLAN

THAT COVERS ALL THE MAJOR AREAS OF YOUR FINANCIAL LIFE

Retirement Planning

Personalized roadmap for a comfortable and secure retirement, ensuring you can enjoy your golden years without financial worry.

Tax Planning

Proactive strategies to minimize your tax liability, leaving more money in your pocket to invest in your future.

Estate Planning

Create a legacy that reflects your wishes, ensuring your assets are distributed efficiently and your loved ones are provided for.

Equity Compensation Planning

Strategically manage your stock options and other equity awards, maximizing their value and minimizing your tax burden.

College Education Planning

Develop a plan to fund your children's education, securing their future and reducing financial stress.

plus...

Social Security Planning

Cash Flow & Budgeting

Debt Management

Emergency Fund

Insurance

Risk Management

Purchasing a Home

Employee Benefits Optimization

Real Estate Investments

Business Planning

Start Your Journey to Financial Freedom Today!

24/7 ACCESS TO FINANCIAL PLANNING TOOLS

24/7 ACCESS TO

FINANCIAL PLANNING TOOLS

With Strateon Intelligent Wealth, you can access your financial plan in financial planning software at any time, from budgeting tools to retirement outlooks, and more.

STRATEON INTELLIGENT WEALTH'S

INVESTMENT PHILOSOPHY

Strateon Intelligent Wealth's investment philosophy takes on a long-term strategic approach to investing while reducing expenses (fees and taxes) using low cost, superior risk-adjusted returns, and globally diversified investments.

Tax-Efficient Portfolios

Tax-efficient portfolios help maximize your returns by minimizing tax liabilities, ensuring more of your investment gains contribute to your financial goals.

Lower-Cost Investments

Lower-cost investments, such as ETFs, provide cost savings that can enhance your overall investment returns by minimizing fees and expenses.

Risk-Adjusted Portfolios

Superior risk-adjusted portfolios optimize the balance between risk and return, ensuring you achieve your financial goals with greater stability and confidence.

Diversification

To better control the risk of your portfolio, your investments should be diversified across different industries and across the globe.

Goals-Based Strategic Approach

Your personalized portfolio is constructed with investment allocations that are designed with the intention to achieve your goals.

Value Investing

Value investing offers the advantage of buying undervalued stocks with strong fundamentals, providing potential for larger returns as the market corrects their prices over time.

Core-Satellite

Combine stability with growth potential by balancing a diversified core of low-cost, long-term investments with higher-risk satellite investments aimed at boosting returns.

Rebalancing

Portfolio rebalancing helps maintain your desired asset allocation, reducing risk and enhancing long-term returns by keeping your investments aligned with your financial goals.

Stocks vs Other Investments

Investing in equities (stocks) offers the potential for higher returns and growth compared to bonds or real estate, making them essential for long-term wealth accumulation.

Bitcoin, Crypto, & Digital Financial Assets

Investing in digital financial assets offers the potential for high returns, portfolio diversification, and exposure to innovative financial technologies and decentralized markets.*

FREE PERSONALIZED FINANCIAL ASSESSMENT

FREE PERSONALIZED

FINANCIAL ASSESSMENT

Still Not Sure?

Strateon Intelligent Wealth offers a complimentary Personalized Financial Assessment

If you're not quite sure Strateon Intelligent Wealth is the right financial planner and investment advisor for you, or if you even need one, you can get a free assessment to answer those questions and more. Find out more about Strateon Intelligent Wealth's Personalized Financial Assessment – with NO COST and NO OBLIGATION.